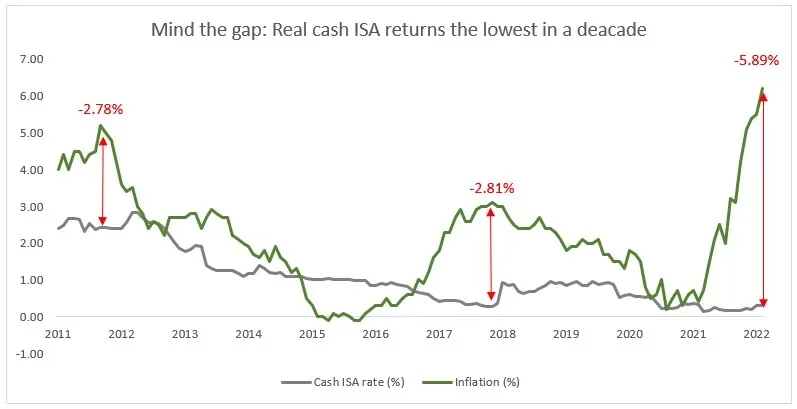

Real Cash ISA returns the lowest in a decade

Rampant inflation and record-low interest rates have pushed the real returns on cash ISAs to the lowest level for more than a decade, according to analysis from Quilter.

With CPI inflation hitting 6.2% in the 12 months to February 2022, and the monthly interest rates available on cash ISA deposits, including unconditional bonuses, standing at just 0.31%, cash ISA savers face a historic real terms loss of 5.89%.

This is the highest real terms loss on cash ISA savings in over a decade, coming in more than double the previous highest loss (-2.81% in November 2017).

Source: ONS, Bank of England, Quilter

And worse is yet to come, with the Bank of England forecasting that inflation will increase to around 8% in the second quarter of 2022, and perhaps reach even higher later this year.

Quilter is warning cash ISA savers to mind the gap, and consider a stocks and shares ISA in the new tax year if they are able to lock the money away for a few years, given stocks and shares have a better chance of keeping pace with inflation.

Someone who invested £10,000 in a cash ISA in January 2011 would currently have £11,269. Adjusted for inflation, this is just £8,962. In contrast, a £10,000 investment in the IA Global Equity index over the same period would be worth £27,124 or £21,583 after inflation.

According to the latest HMRC data available, 13 million adult ISAs were subscribed to in 2019/20, of which three quarters were cash ISAs.

Rosie Hooper, chartered financial planner at Quilter, commented:

“With inflation hitting lofty heights and set to rise even further, cash ISA savers will be getting less and less bang for their buck in the months and years ahead.

“Cash ISAs have, for a long time, been an easy way to save money with comparatively little risk. But now with inflation hitting 30-year highs and interest rates on cash savings remaining low, the time may have come for people to consider alternatives.

“If you won’t be needing the money in the next few years, investing could help make your cash work harder, and has a better chance of delivering an above-inflation level of return.

“A good rule of thumb is to save six months of your salary in cash and then invest in a spread of different assets that can deliver a long-term return. But everyone’s circumstances are different, which is why it’s important to seek your own individual financial advice.”

Rosie’s tips for getting started with investing:

- Diversify, diversify, diversify: The first rule of investing is to diversify your portfolio to reduce the risk. For example, by buying a range of shares and having a diverse asset allocation including bonds, property and alternatives.

- Understand what you are investing in: The investment universe is enormous and growing at a rapid rate. It is important to know exactly what you are buying, what the return drivers are and what the risks are.

- Have a realistic plan: Investing is a marathon, not a sprint. You need to know how much you can realistically set aside each month to invest, understand your capacity for loss, and get exposure to a suitable amount of risk given your investment objectives.

- Beware of social media money ‘mentors’: When people want to invest, they often turn to social media for tips. But anyone can set up a profile and start offering advice so be careful who you trust. If you are unsure and want an expert to guide you through, stick to regulated and trusted financial advice.

- Remind yourself of scam red flags: Investment scams facilitated online and on social media are becoming more and more prevalent. Be wary of an investment proposition that offers an unrealistic rate of return, which downplays the risks or puts you under time pressure to make a decision. If in doubt, check the FCA’s register and make sure you a dealing with a regulated financial services firm. For more information visit https://www.fca.org.uk/scamsmart.

www.tpfinancialsolutions.co.uk/investments